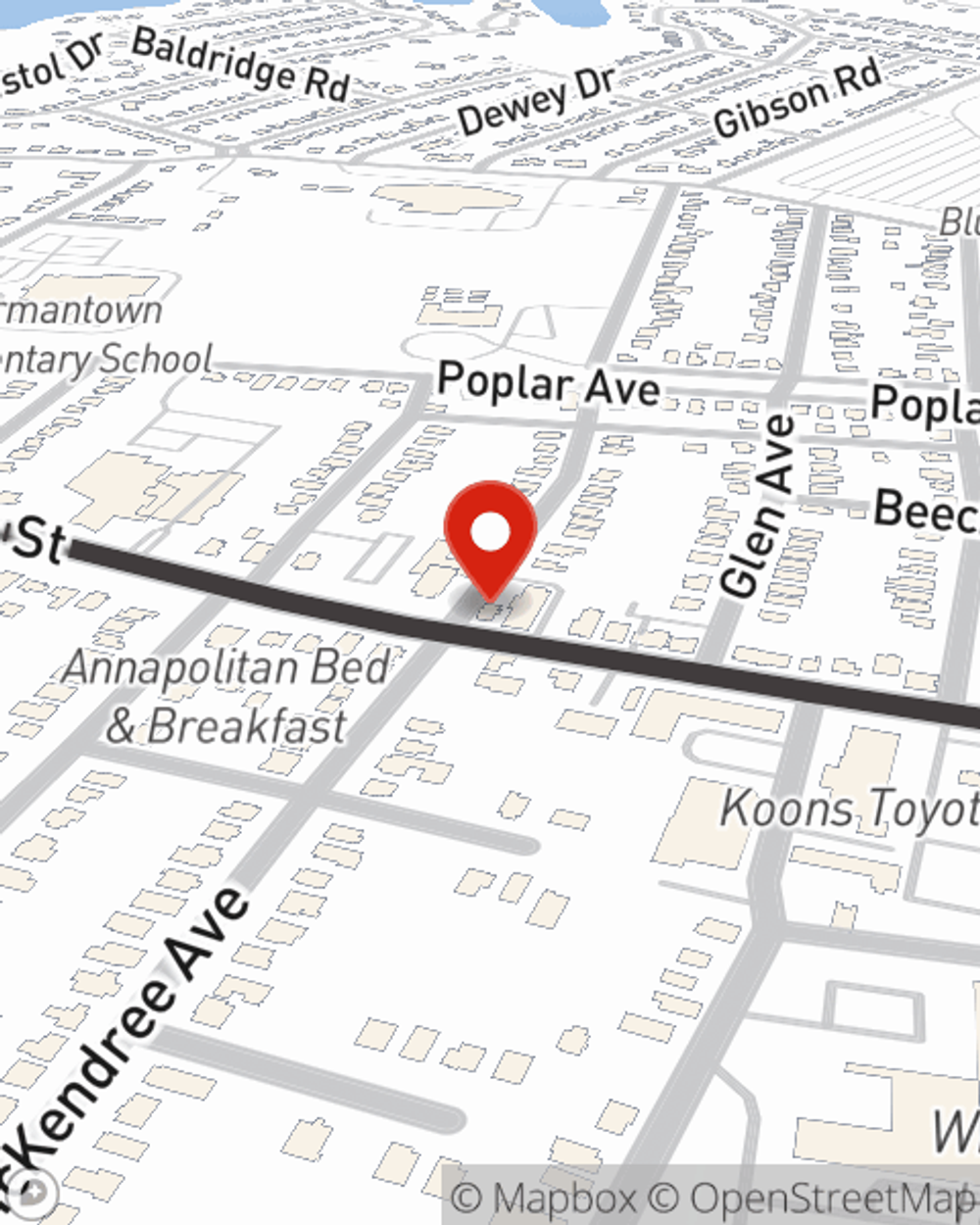

Condo Insurance in and around Annapolis

Welcome, condo unitowners of Annapolis

State Farm can help you with condo insurance

Condo Sweet Condo Starts With State Farm

Are you committing to condo ownership for the first time? Or have you owned one for a while? Either way, it can be a good idea to get coverage for your condo unit with State Farm's Condo Unitowners Insurance.

Welcome, condo unitowners of Annapolis

State Farm can help you with condo insurance

Why Condo Owners In Annapolis Choose State Farm

With this coverage from State Farm, you don't have to be afraid of the unanticipated happening to your most personal possessions. Agent John Thibodeau can help provide all the various options for you to consider, and will assist you in constructing an excellent policy that's right for you.

If you're ready to bundle or check out more about State Farm's terrific condo insurance, call or email agent John Thibodeau today!

Have More Questions About Condo Unitowners Insurance?

Call John at (410) 268-3101 or visit our FAQ page.

Simple Insights®

Portable moving pods: A new approach to moving

Portable moving pods: A new approach to moving

Portable moving pods can offer new advantages for the moving process. Decide what’s easiest and cheapest for you.

Tips for dealing with lead paint

Tips for dealing with lead paint

Homes built before 1978 might contain lead-based paint -- one of the most common causes of lead poisoning, according to the Environmental Protection Agency.

John Thibodeau

State Farm® Insurance AgentSimple Insights®

Portable moving pods: A new approach to moving

Portable moving pods: A new approach to moving

Portable moving pods can offer new advantages for the moving process. Decide what’s easiest and cheapest for you.

Tips for dealing with lead paint

Tips for dealing with lead paint

Homes built before 1978 might contain lead-based paint -- one of the most common causes of lead poisoning, according to the Environmental Protection Agency.